The latest Greensill hearings in Parliament, with Lex Greensill being questioned, has highlighted that less than 10% of their trading was Supply Chain Finance (SCF) and that over 90% of its activities were in lending through a range of complex opaque structures.

The fact that globally SCF is used to support suppliers working capital needs to the tune of over $1.3Tr highlights its importance. Indeed, as businesses eye getting back on track, smart CFO’s have been evaluating how they can deploy SCF programmes to help suppliers get back on their feet and get supply chains running at 100% again.

But Greensill has been a timely reminder of bad practice, and in this blog, we try to decode some of the looming questions, which would support the selection of an optimal SCF solution.

Decoding some looming questions

Accounting practices

Recent years have seen the accounting treatment by some parties given to Supply Chain financing leading to the evolution of so called “creative accounting” methods.

This sort of accounting method bases its premise towards a more market-based outlook, rather than the actual/ current value. Assets get valued based on the modelled estimates of the future cash flows they will generate, rather than being priced on the actual value being paid today.

This enabled businesses to recognise profits instead of having actual cash flows supporting them. Such support can lead corporates retaining cash, reporting higher net cashflows, and disguising actual debt.

Learning

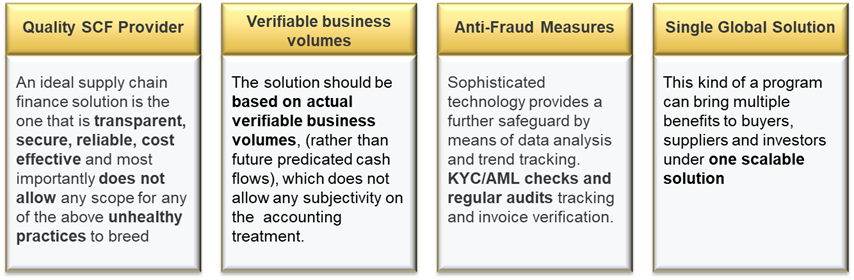

However, there is no reason to deviate from normal accounting practices if the true purpose of the SCF programme is to generate working capital. Regardless of SCF, the money is still owed, creditors increase as a liability on the balance sheet, and cash increases under current assets. The creditor may now be a 3rd party funder who takes the place of the supplier but in essence the creditor position remains.

For the corporate, that increase in cash/working capital is a prize in itself and is mirrored by the supplier who has a decrease in Debtors, but an increase in cash.

There is no magic, only transparency, and a gain in cash which is invaluable to everyone particularly with the working capital pressures caused by Covid.

Funding Structures

From the Greensill revelations, there are many questions on the way SCF programmes are packaged.

Their mechanism worked in the way that debts were repackaged and resold under a new instrument, which in fact was the same debt of a corporate. In many cases lending was not against the security of invoices for transactions that had already occurred, but against the “prospective receivables” or the now famous term “future receivables” that the company might generate in the future.

This sort of repackaged debt instrument enabled the real concentration risk to be hidden as the main debt of that instrument turned out to be one single organisation or more than 50% of that organisation.

For the corporate, this obviously raises questions for treasurers today, as to how their lending portfolio is being packaged and bundled to a third party, potentially creating longer term issues.

Learning

In essence, there should be no need to bundle short tenor transactions in such a way.

Invoice fraud and data duplication

It has been seen that businesses could fraudulently finance their invoices via multiple funders and other channels such as factoring. Indeed, 2019 and 2020, was dominated by large global commodity players, and other corporates, who used weak technology and poor practices to facilitate invoice duplication and fraud. When that affects the Funders, through default, it risks the continuity of an entire SCF programme.

The first impact is that insurers withdraw their cover for such services, and then major global banks, reduce their exposure, and gradually pull out of this lending space.

Learning

The supplier onboarding mechanisms used by the SCF provider will give an insight into their approach to risk. Ensuring that the technology used to support the SCF programme combines anti-fraud mechanisms and processes is key to ensure that Funders do not lose as a result of the risk of multiple funding of invoices.

Insurance

Credit Insurance, providing mitigation towards the risk of non-payment can be an important risk management tool for all types of businesses in SCF transactions. One of Greensill’s insolvency triggers was the non-renewal of insurance policies.

The bundling of low and high risks within a blended insurance policy seems a clever way to achieve a lower overall cost of finance. However, If the funding capacity relies on that kind of insurance only, then this can result in the withdrawal of funding capacity, once the real risk becomes visible and the insurance rejected.

Learning

Once transactions become securitised, bundled and include opaque future transactions, then the validity of the insurance quickly comes into question, and risks the sustainability of the SCF programme.

Transparency is crucial to insurance pricing and if insurance is used to support an SCF programme, the corporate should review the main policy terms to ensure that there is not an inherent risk to their SCF programme caused by opaque structures.

An Optimal SCF Program

Crossflow

Crossflow is one of the leaders in working capital solutions and was recently ranked as the fastest growing B2B Fintech in the Financial Times FT’s 2021 fastest growing companies (FT Article).

- Funder Diversity - There are wide range of FI’s funding SCF programmes through Crossflow. These range from banks to HNI’s to family offices, who have trust in Crossflow’s capabilities. Our wide array of corporates SCF programmes provides investors with a diverse group of investable asset classes.

- Asset selection - Crossflow’s platform is powered by technology, which allows the investors/funders to choose their preferred asset class.

- Pricing - Crossflow utilises a pricing algorithm which aligns pricing to market demand.

- Security - Transaction security is ensured through Crossflow technology and processes.

Summary

SCF is one of the most effective and prudent ways to manage working capital and liquidity in companies for both corporates and suppliers.

However, the selection of the right SCF provider selection is crucial. Crossflow has been built as a real Fintech solution for SCF, with a low-cost base, which does not need to create opaque financial structures to cover these costs.

Crossflow has focused on the mechanics of SCF, ensuring that we built resilience, security and scalability, as the core of our service.

The result is an SCF service driving our growth as Europe’s fastest growing fintech.

Please don’t hesitate to contact us if you would like to join our SCF community.

Tony Duggan is co-founder and CEO of Crossflow. He served as Supply Chain Director at Wickes and B&Q prior to serving as Product Development Director at SWIFT, the global banking network. He also managed an outsourced fintech development project for HSBC in Hong Kong.